Reflexivity Within the Bitcoin Ecosystem

Impact on Adoption and Volatility

Bitcoin is up 32% since the record-breaking ETFs launched last month, marking a significant milestone in the cryptocurrency’s journey. While the price gains are welcome, they are only a part of the story. The essence of Bitcoin’s current narrative revolves around its reflexivity—a concept that is becoming increasingly relevant in its ecosystem.

What is Reflexivity in Finance?

Reflexivity is a concept where the perceptions and actions of investors create a feedback loop with the market fundamentals, influencing each other in a self-reinforcing cycle. This phenomenon, where a higher price improves fundamentals and drives increased demand, leading to even higher prices. This concept was brought to the forefront by George Soros in his seminal work, “The Alchemy of Finance.” With its unique market dynamics, Bitcoin is a prime example of this theory in action.

The Reflexivity of Bitcoin

The spot Bitcoin ETF launch is the most successful in its history, initiating a virtuous cycle of increasing prices. This development is not just speculative it is rooted in the social dynamics of Bitcoin’s reflexivity during a bull run.

Let’s piece this out:

- ETF-induced demand boosts Bitcoin’s price.

- Rising prices garner media attention, further spotlighting Bitcoin.

- Increased public discourse around Bitcoin stimulates buying, validating early adopters’ predictions.

- This cycle of rising prices and growing interest perpetuates, showcasing a live feedback loop.

Although the ETFs trigger this period of reflexive growth, Bitcoin’s funding is more diversified.

MicroStrategy recently acquired $155 million in Bitcoin at just under $52,000 per coin, increasing their total holdings to 193,000 BTC. El Salvador’s continued investment in Bitcoin underscores the broadening base of institutional and sovereign support for cryptocurrency. Despite this influx of big players, the retail investors’ return to the market looms on the horizon as a significant potential catalyst for further growth.

Demand is Rising, What About the Supply?

Michael Saylor eloquently highlights the unique situation Bitcoin finds itself in: “Demand is going to increase, supply is going to contract… this is fairly unprecedented in the history of Wall Street… so if you have got a 12-month to 48-month time horizon, this is a pretty ideal entry point into the asset.” With a capped supply of 21 million coins, of which 19.6 million have already been mined, and a halving event that reduces the issuance rate every four years, Bitcoin’s scarcity is unparalleled.

The next halving, expected around April 20th, will further constrain the new supply, underscoring Bitcoin’s position as the scarcest commodity globally.

As Bitcoin’s market cap inches closer to surpassing that of gold, speculation abounds regarding its price potential, with predictions suggesting a value of over $700k USD per Bitcoin. This prospect has caught the attention of investors from all quarters, including those traditionally invested in gold ETFs. Meanwhile, figures like Peter Schiff, known for their scepticism towards Bitcoin, find their positions increasingly challenged by Bitcoin’s performance.

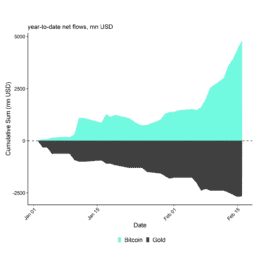

Cumulative Sum of Bitcoin and Gold ETP Flows

Source: ETC Group

Bitcoin has many similarities to gold due to its proof-of-work mining algorithm that transfers physical electrical energy into the digital realm.

Do You Own Enough Bitcoin?

The reflexivity of Bitcoin’s market is not just a theoretical construct but a reality unfolding in real-time. The confluence of increased institutional interest, limited supply, and the impending halving event sets the stage for a significant rally in 2024. With analysts predicting favourable economic conditions and regulatory changes, the stage is set for Bitcoin to enter a new era of growth and acceptance.

About George Soros

George Soros, born in Budapest in 1930, is a Hungarian-American billionaire investor and philanthropist. As the founder of Soros Fund Management, he is well-known for his investment acumen, notably for his bet against the British pound in 1992, which earned him the nickname “The Man Who Broke the Bank of England.” Soros is also celebrated for his contributions to philanthropy, having donated billions through his Open Society Foundations, which work to promote democracy, human rights, and freedom of expression across the globe.

About Peter Schiff

Peter Schiff is an American stock broker, financial commentator, and radio show host known for his bearish views on the US economy and his advocacy for gold and precious metals as an investment. Born in 1963, Schiff is the CEO and chief global strategist of Euro Pacific Capital Inc., a brokerage firm based in Westport, Connecticut. He gained public attention for his accurate predictions of the 2008 financial crisis and has since been a vocal critic of modern monetary policy and fiat currency, despite his skepticism towards cryptocurrencies like Bitcoin.

Sign up to our newsletter

Coach Mason

Discovering cryptocurrency's potential for global equality in 2014, Coach Mason delved deep into the transformative tech. Frequently sought for crypto wisdom, he realized the value of sharing collective insights. Away from screens and blockchain buzz, he finds balance skateboarding, playing ice hockey, and on the yoga mat, effortlessly blending tech, traction, and tranquility.

Top Crypto-Friendly Countries in 2024

03/06/2024

Maximize your crypto opportunities in 2024. Discover which countries offer the best environment for crypto.

Exploring Web3: The Dawn of a Decentralized Internet

08/05/2024

Join us in unraveling the layers of Web3, the next frontier in internet evolution that promises a decentralized,…

Blockchain Battles; Solana vs Ethereum

12/04/2024

Join us in "Blockchain Battles," where we compare Ethereum and Solana, not to declare a winner but to appreciate their…

What is cryptocurrency?

Where to buy cryptocurrency?

How to buy cryptocurrency?

Manage cryptocurrency

Disclaimer

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for investors who can make their investment decisions without advice. The information contained in our publications is not, and should not be read as, an offer or recommendation to buy or sell or a solicitation of an offer or recommendation to buy or sell any cryptocurrency. Prices of cryptocurrency may go down as well as up and you may not get back the original amount invested. You should not buy cryptocurrency with money you cannot afford to lose. To see our full disclaimer click here.